texas estate tax calculator

Open an Account Earn 14x the National Average. In 2018 the thresholds for a single persons Texas estate tax were estimated to be 58 million and 112 million for a married.

Es402 Introduction To Estate Gift Tax

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code.

. An estate tax is a tax imposed on the total value of a persons estate at the time of their death. Government Websites by CivicPlus Calculate an estimate of your property taxes. Skip to Main Content.

For comparison the median home value in Austin County is. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The calculator will show you the total sales tax amount as well as the county city and.

Property Tax Calculator - Estimator for Real Estate and Homes. Counties in Texas collect an average of 181 of a propertys assesed fair market. To use our Texas Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Delaware DE Transfer Tax. 1720 of Assessed Home Value. 1925 of Assessed Home Value.

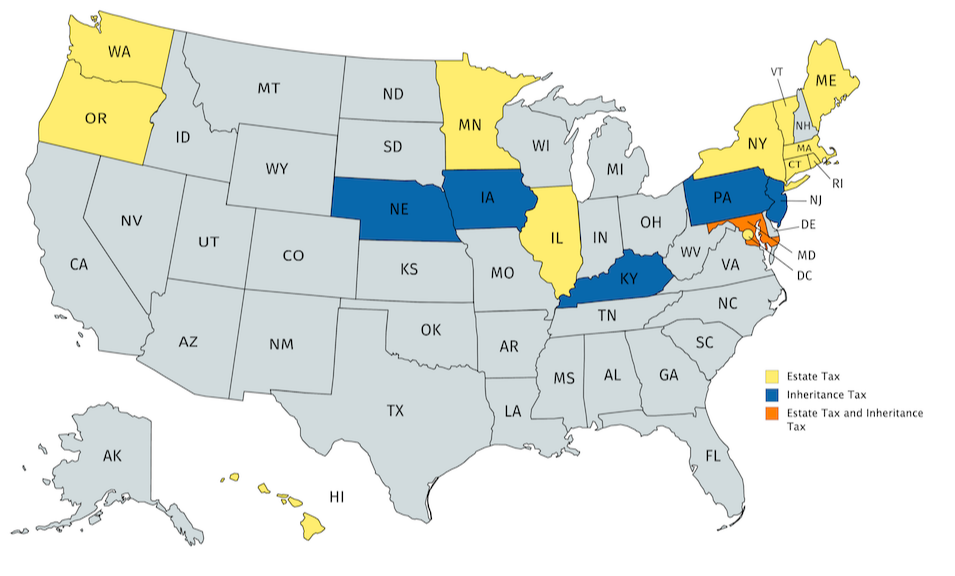

A key part of estate planning is helping reduce estate and inheritance tax. Easy 247 Online Access. Texas estate tax calculator Tuesday May 24 2022 Edit.

The State of Delaware transfer tax rate is 250. County and School Equalization. Regardless of the size of your estate you wont owe estate taxes to the state of Texas.

It is sometimes referred to as a death tax Although states may impose their own. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. No monthly service fees.

New York County 4813. Simply put property taxes are taxes levied on real estate by governments. Loading Do Not Show Again Close.

The property tax is used to finance the States 254 counties over 1200 cities 1022 independent school districts and more than 1800 special districts. In Texas the federal estate tax limits apply. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Harris Countys 3356 median annual property tax payment and 165300 median home value.

For comparison the median home value in Texas is 12580000. After a few seconds you will be provided with a full breakdown of the. While the state does not appraise property values set property tax rates or collect property taxes they set the operating rules for political subdivisions imposing and administering them.

You can use our Texas.

How To Calculate Capital Gains Tax On Real Estate Investment Property

Gas Tax Rates By State 2020 State Fuel Excise Taxes Tax Foundation

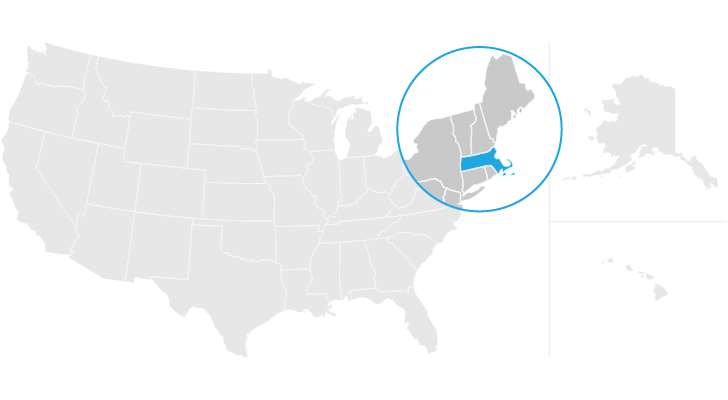

Massachusetts Estate Tax Everything You Need To Know Smartasset

Individual Income Taxes Urban Institute

Property Taxes By State How High Are Property Taxes In Your State

Harris County Tx Property Tax Calculator Smartasset

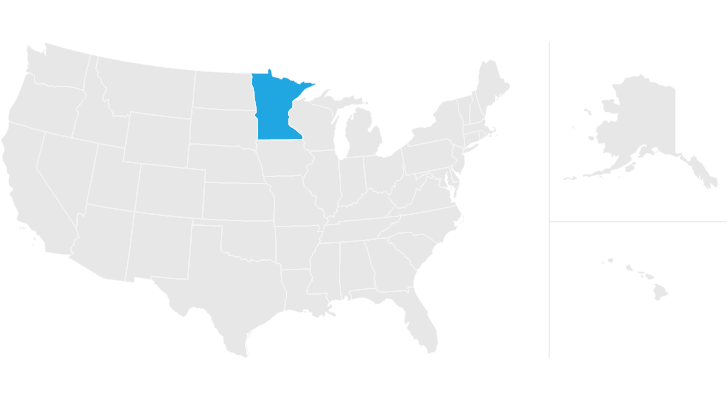

Minnesota Estate Tax Everything You Need To Know Smartasset

Texas Income Tax Calculator Smartasset

![]()

Estate Tax Calculator Estate Tax Liability Planning Jackson Hewitt

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Estate Planning 101 Your Guide To Estate Tax In Georgia

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

2022 2023 Tax Brackets Rates For Each Income Level

Texas Estate Tax Everything You Need To Know Smartasset

How To Calculate Sales Tax Methods Examples Video Lesson Transcript Study Com